Unlocking the Magic of Walt Disney Stock: A Comprehensive Guide to DIS

Table of Contents

- Walt Disney (DIS) Stock Price Prediction And Forecast 2023 – 2030 ...

- Why Is Everyone Talking About Disney Stock? | The Motley Fool

- Disney Stock Down Nearly 9% Since Yesterday’s Closing - Disney by Mark

- WALT DISNEY Stock Chart Fibonacci Analysis 032723 – fibonacci6180

- Disney Stocks Soar as Analyst Claims “The Magic Is Back” | Disney Dining

- Disney Stock Has a Lot to Prove This Week | citybiz

- Walt Disney Company Stock Had Its WORST Year Since 1974 - Disney by Mark

- Florida Won’t Sink Disney Stock — But a Bigger Problem Looms

- Iger Told to Sell Disney Park Assets Due to Major Stock Price Dips ...

- Disney Stocks Soar as Analyst Claims “The Magic Is Back” | Disney Dining

Introduction to Walt Disney Stock (DIS)

Current Market Trends and Performance

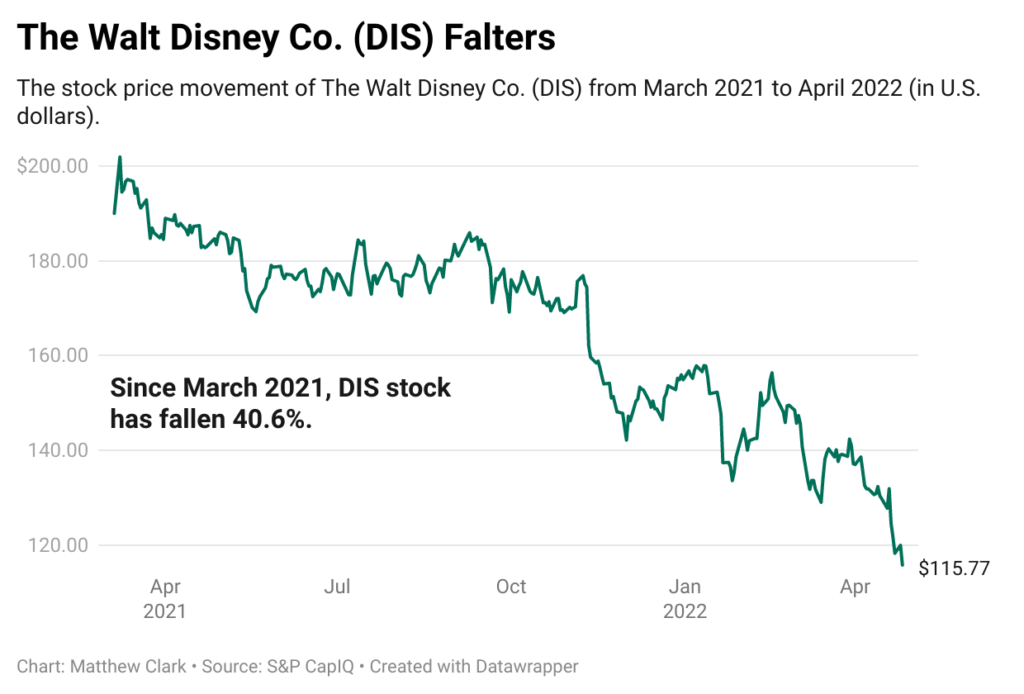

According to Markets Insider, Disney's stock has been trading at around $180 per share, with a 52-week high of $203.02 and a 52-week low of $112.66. The stock's price-to-earnings (P/E) ratio stands at approximately 25, indicating a relatively high valuation compared to its industry peers.

Key Drivers of Growth

Several factors are driving the growth of Walt Disney stock, including: Streaming services: Disney+'s success has been a major catalyst for the company's growth, with plans to expand its content offerings and reach new markets. Theme park and resort expansion: Disney's theme parks and resorts continue to attract millions of visitors worldwide, with new expansions and renovations planned for the coming years. Film and television production: Disney's film and television studios continue to produce blockbuster content, including Marvel and Star Wars franchises, which contribute significantly to the company's revenue.

Future Outlook and Challenges

While Walt Disney stock has been performing well, the company faces challenges in the form of increasing competition from other streaming services, such as Netflix and Amazon Prime. Additionally, the COVID-19 pandemic has had a significant impact on the company's theme park and resort business, with attendance and revenue declining in recent years.However, with its strong brand portfolio, diversified revenue streams, and commitment to innovation, Disney is well-positioned to navigate these challenges and continue its growth trajectory. As the company expands its streaming services, invests in new technologies, and develops new content, investors can expect Walt Disney stock to remain a top performer in the entertainment industry.

Walt Disney stock, listed as DIS, is a compelling investment opportunity for those looking to tap into the magic of the entertainment industry. With its rich history, diverse portfolio of brands, and commitment to innovation, Disney is poised for continued growth and success. As the company navigates the evolving media landscape, investors can expect Walt Disney stock to remain a top performer, making it an attractive addition to any investment portfolio.Stay up-to-date with the latest news and trends on Walt Disney stock and other market movers with Markets Insider.