Maximizing Your Finances: Expert Tips on How to Save Money in 2024

Table of Contents

- Saving and investment concept - Year 2024 with coins Stock Photo - Alamy

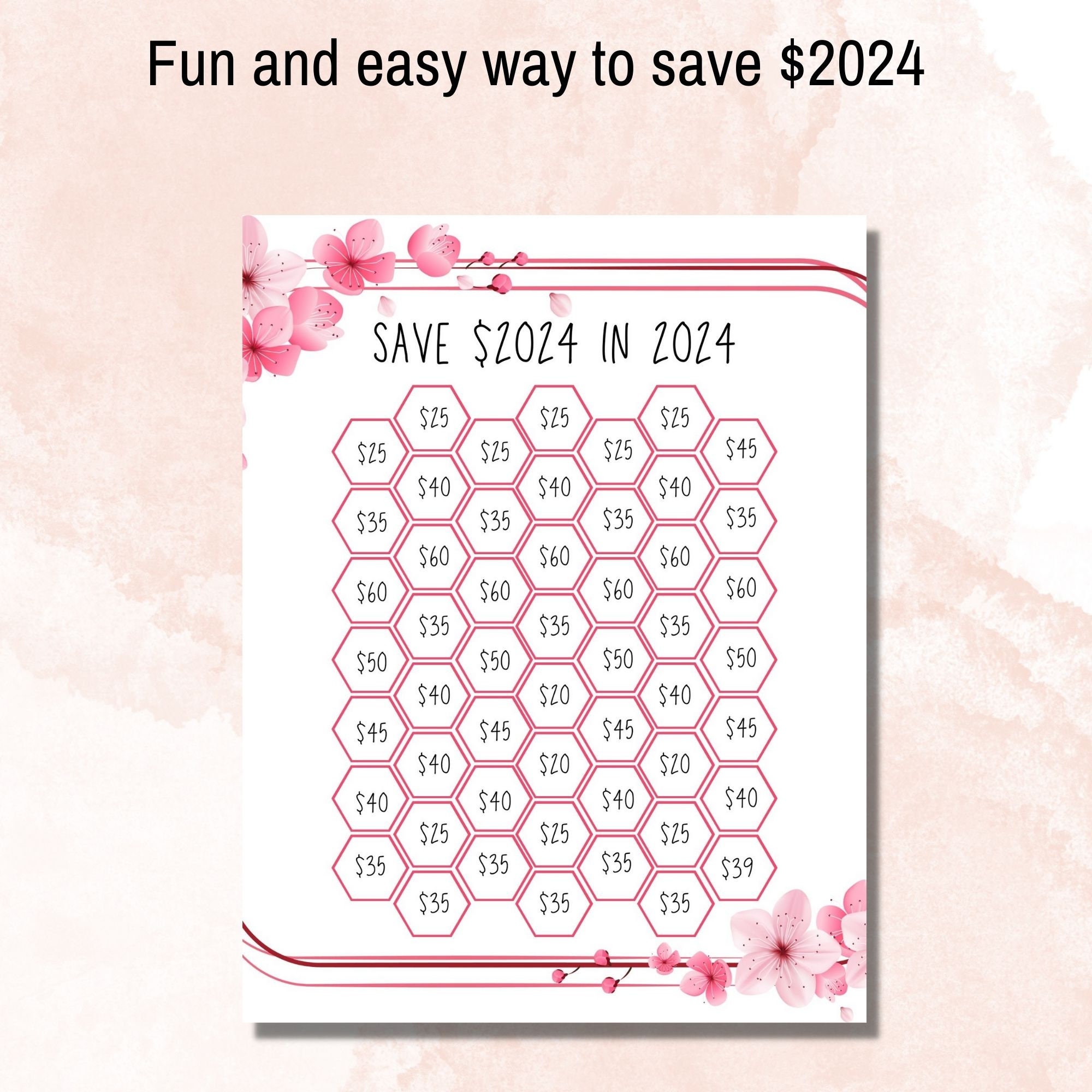

- 2024 Savings Challenge | Money saving methods, Money saving strategies ...

- Top Savings Tips 2024: Boost Your Finances

- Top 10 Money-Saving Challenges You Should Try In 2024 | Honeygain

- Save 2024 in 2024, Save 2024 in 2024 Saving Tracker, Save 2024 in 2024 ...

- Pin on Money saving plan in 2024 | Financial life hacks, Business money ...

- 2024년 캐리 운세 무엇이든 물어 보살 |Carrie fortune for 2024, ask for anything 달려라 ...

- Top Savings Tips 2024: Boost Your Finances

- Pin by Bekbueno on Money in 2024 | Money pictures, Counting money ...

- 2024 Awards Season: What Styles To Expect Next - Trend Report - Club L ...

Understanding the Importance of Saving

1. Create a Budget

The first step towards saving money is to understand where your money is going. Creating a budget helps you track your income and expenses, making it easier to identify areas where you can cut back. Consider using the 50/30/20 rule as a guideline: 50% of your income should go towards necessary expenses like rent and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

2. Automate Your Savings

Setting up an automatic transfer from your checking account to your savings or investment account is a simple yet effective way to save money. By automating your savings, you ensure that you save a fixed amount regularly, without having to think about it. You can set up automatic transfers through your bank's online platform or mobile app.

3. Cut Back on Subscriptions

In today's digital age, it's easy to accumulate multiple subscriptions for streaming services, software, and memberships. However, many of these subscriptions often go unused. Review your subscriptions and cancel any that you don't use regularly. This simple step can help you save hundreds of dollars each year.

4. Shop Smart

Shopping smart involves looking for deals, using coupons, and buying in bulk. Consider shopping during sales periods or using cashback apps that offer rewards on your purchases. Additionally, planning your meals and making a grocery list can help reduce food waste and save you money on groceries.

5. Invest Wisely

Investing your savings can help your money grow over time. Consider consulting with a financial advisor to find investment options that align with your financial goals and risk tolerance. Investopedia offers a wealth of information on investment strategies and financial planning. Saving money in 2024 requires discipline, patience, and a well-thought-out strategy. By creating a budget, automating your savings, cutting back on unnecessary expenses, shopping smart, and investing wisely, you can make significant progress towards your financial goals. Remember, saving is a long-term process, and every small step counts. Start your savings journey today and secure a brighter financial future for yourself and your loved ones. For more financial tips and news, visit CBS News and stay updated on the latest economic trends and advice from financial experts.Word Count: 500