Get Ready for Tax Season: DFAS Reveals Release Date of Crucial Tax Documents

Table of Contents

- 2024 W2 Irs - Mandi Rozella

- Form W-2 (2024) | Fill and sign with Lumin

- W2.docx

- Go Paperless for W-2s - Consumer Direct Care Network Washington

- Irs Form W3c Fillable - Printable Forms Free Online

- Tax Season 2024: Here's What to Do If You Haven't Received Your W-2 Yet ...

- Free W2 Template Of Blank Dd form 214 Pdf forms 4626 ...

- When will you get your W2? Here's what you need to know

- Tax Season 2024: Here's What to Do If You Haven't Received Your W-2 Yet ...

- 2020 W2s should be up, a few days earlier than expected : r/OfficeDepot

The DFAS has confirmed that tax documents, including W-2s and 1099s, will be available to eligible recipients starting from January 22nd. This announcement is significant, as it provides taxpayers with a clear timeline for when they can expect to receive their tax documents, allowing them to plan and prepare their tax returns accordingly.

What Tax Documents Will Be Released?

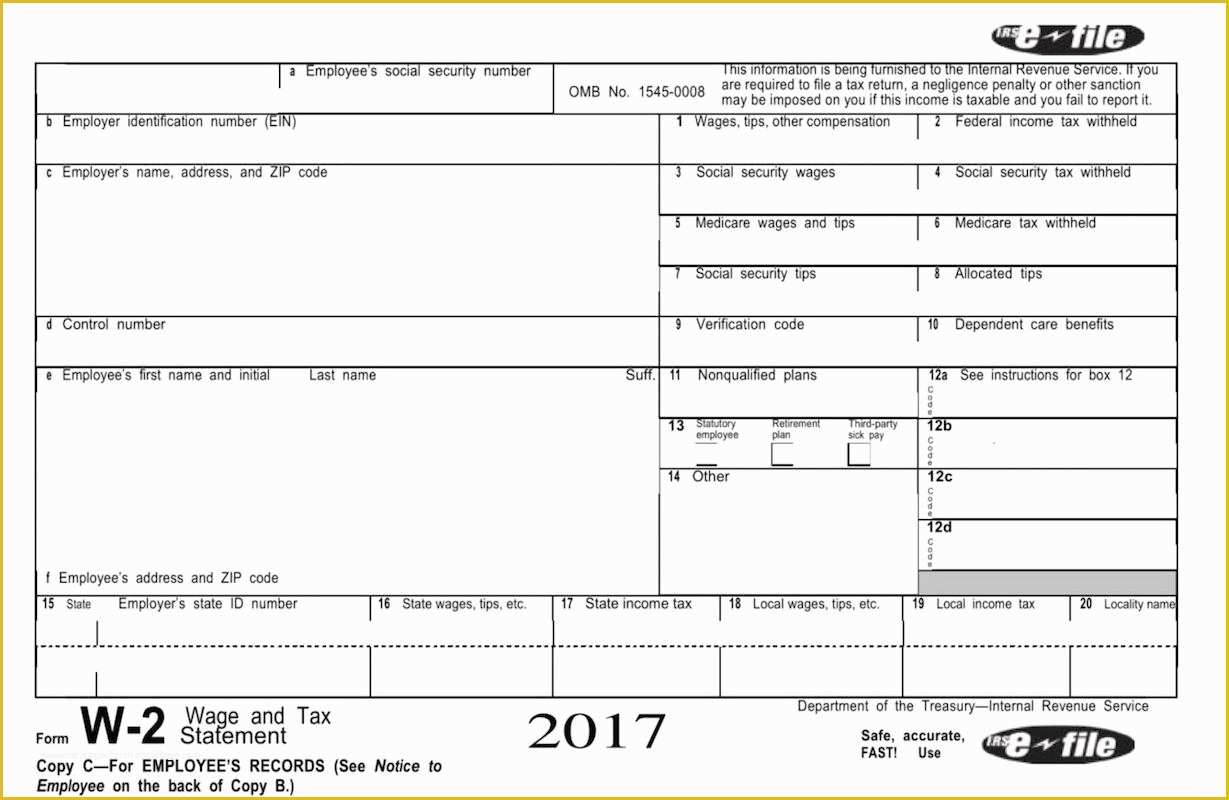

- W-2s: These documents will be available for military personnel, federal civilian employees, and other eligible recipients who earned income in the previous tax year.

- 1099s: These documents will be released for individuals who received non-employee compensation, such as contractors and freelancers.

These tax documents are essential for taxpayers to complete their tax returns, and receiving them on time will help ensure a smooth and efficient tax filing process.

How to Access Your Tax Documents

Eligible recipients can access their tax documents through the DFAS website or through the myPay online portal. To access your documents, simply log in to your account, navigate to the tax documents section, and download or print your W-2 or 1099.

Preparing for Tax Season

With the release date of tax documents announced, it's essential to start preparing for tax season. Here are some tips to help you get ready:- Gather all necessary documents, including your W-2, 1099, and any other relevant tax documents.

- Review your tax withholding and adjust it if necessary to avoid any potential tax liabilities.

- Consider consulting a tax professional or using tax preparation software to help with your tax return.

By staying informed and preparing ahead of time, you can ensure a stress-free tax season and take advantage of the tax credits and deductions you're eligible for.

The release of tax documents by the DFAS is an essential milestone in the tax season calendar. With the announced release date, taxpayers can now plan and prepare their tax returns with confidence. Remember to access your tax documents through the DFAS website or myPay portal, and start gathering all necessary documents to ensure a smooth tax filing process. By being proactive and prepared, you can navigate tax season with ease and make the most of your tax return.Stay tuned for more updates and announcements from the DFAS, and don't hesitate to reach out to a tax professional if you have any questions or concerns about your tax return.